—————————

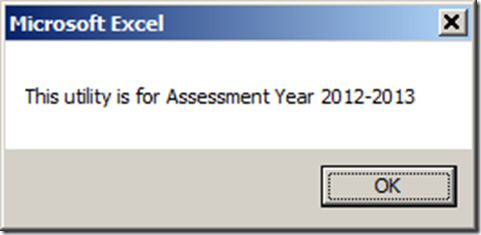

Microsoft Excel

—————————

This utility is for Assessment Year 2012-2013

—————————

OK

—————————

—————————

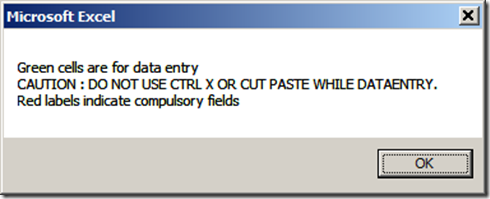

Microsoft Excel

—————————

Green cells are for data entry

CAUTION : DO NOT USE CTRL X OR CUT PASTE WHILE DATAENTRY.

Red labels indicate compulsory fields

—————————

OK

—————————

—————————

Microsoft Excel

—————————

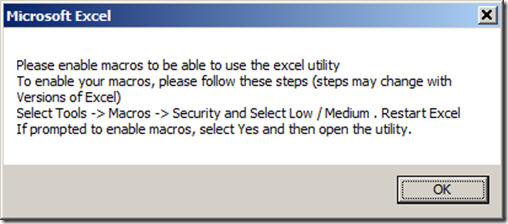

Please enable macros to be able to use the excel utility

To enable your macros, please follow these steps (steps may change with Versions of Excel)

Select Tools -> Macros -> Security and Select Low / Medium . Restart Excel

If prompted to enable macros, select Yes and then open the utility.

—————————

OK

—————————

—————————

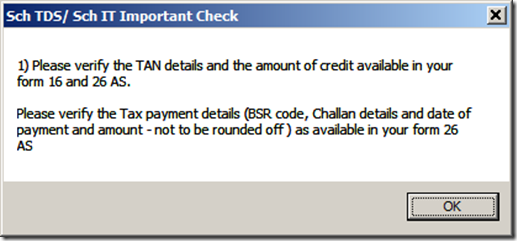

Sch TDS/ Sch IT Important Check

—————————

1) Please verify the TAN details and the amount of credit available in your form 16 and 26 AS.

Please verify the Tax payment details (BSR code, Challan details and date of payment and amount – not to be rounded off ) as available in your form 26 AS

—————————

OK

—————————

—————————

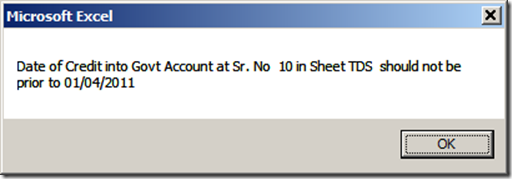

Microsoft Excel

—————————

Date of Credit into Govt Account at Sr. No 10 in Sheet TDS should not be prior to 01/04/2011

—————————

OK

—————————

—————————

Microsoft Excel

—————————

Sheet is ok

—————————

OK

—————————

—————————

Microsoft Excel

—————————

To Save the XML which, you have to click on the SAVE XML button on this sheet.

—————————

OK

—————————

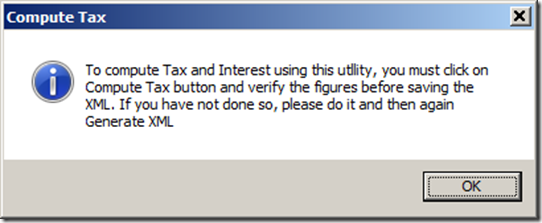

—————————

Compute Tax

—————————

To compute Tax and Interest using this utllity, you must click on Compute Tax button and verify the figures before saving the XML. If you have not done so, please do it and then again Generate XML

—————————

OK

—————————

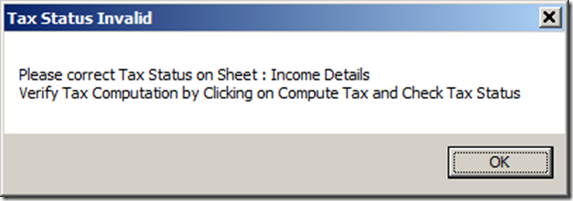

—————————

Tax Status Invalid

—————————

Please correct Tax Status on Sheet : Income Details

Verify Tax Computation by Clicking on Compute Tax and Check Tax Status

—————————

OK

—————————

—————————

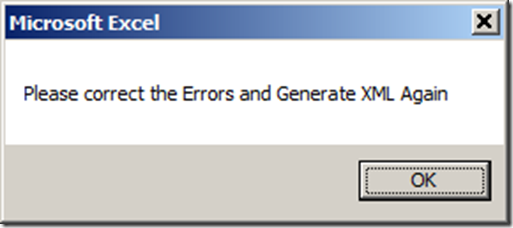

Microsoft Excel

—————————

Please correct the Errors and Generate XML Again

—————————

OK

—————————

—————————

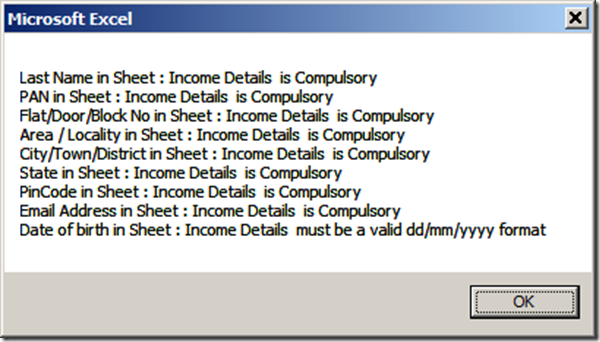

Microsoft Excel

—————————

Last Name in Sheet : Income Details is Compulsory

PAN in Sheet : Income Details is Compulsory

Flat/Door/Block No in Sheet : Income Details is Compulsory

Area / Locality in Sheet : Income Details is Compulsory

City/Town/District in Sheet : Income Details is Compulsory

State in Sheet : Income Details is Compulsory

PinCode in Sheet : Income Details is Compulsory

Email Address in Sheet : Income Details is Compulsory

Date of birth in Sheet : Income Details must be a valid dd/mm/yyyy format

—————————

OK

—————————

—————————

Microsoft Excel

—————————

INVALID PAN

—————————

OK

—————————

—————————

Microsoft Excel

—————————

Last Name in Sheet : Income Details is Compulsory

PAN in Sheet : Income Details is Compulsory

Flat/Door/Block No in Sheet : Income Details is Compulsory

Area / Locality in Sheet : Income Details is Compulsory

City/Town/District in Sheet : Income Details is Compulsory

State in Sheet : Income Details is Compulsory

PinCode in Sheet : Income Details is Compulsory

Email Address in Sheet : Income Details is Compulsory

Date of birth in Sheet : Income Details must be a valid dd/mm/yyyy format

—————————

OK

—————————

—————————

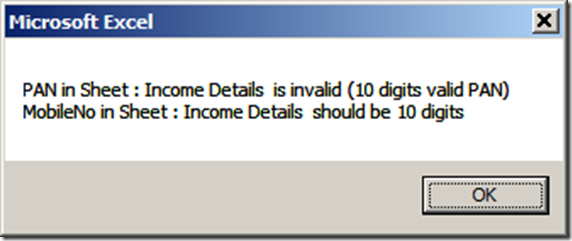

Microsoft Excel

—————————

PAN in Sheet : Income Details is invalid (10 digits valid PAN)

MobileNo in Sheet : Income Details should be 10 digits