Requirement:

When you are a salaried employee, your employer usually deducts the tax as TDS from your salary. However, I you have additional earnings then you require to show up them while filing the IT returns and pay the liable tax by yourself. The very common additional income includes interest you earned on your Fixed Deposits in the bank. Usually your bank deducts the tax for the interest at flat 10%, but if your earnings fall under 20% slab then you need to pay the remaining 10% tax on the interest you earned.

You can pay Income tax in India through online at https://www.tin-nsdl.com/ website. For individual tax payer, below are the steps to be used:

Steps to pay your income tax yourself (Self Assement Tax) online:

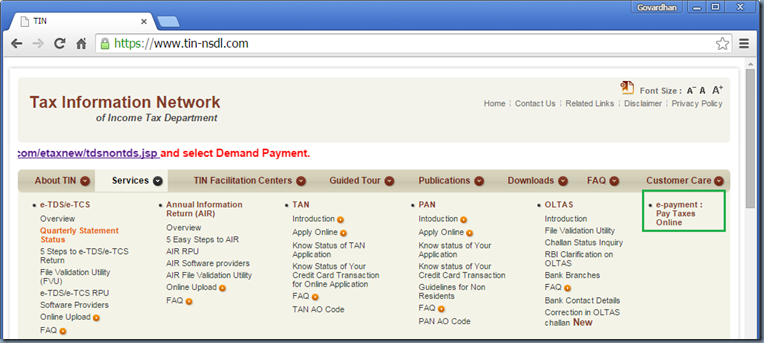

- Go to https://www.tin-nsdl.com/

- Click on e-payment : Pay Taxes Online Under Services section as shown below.

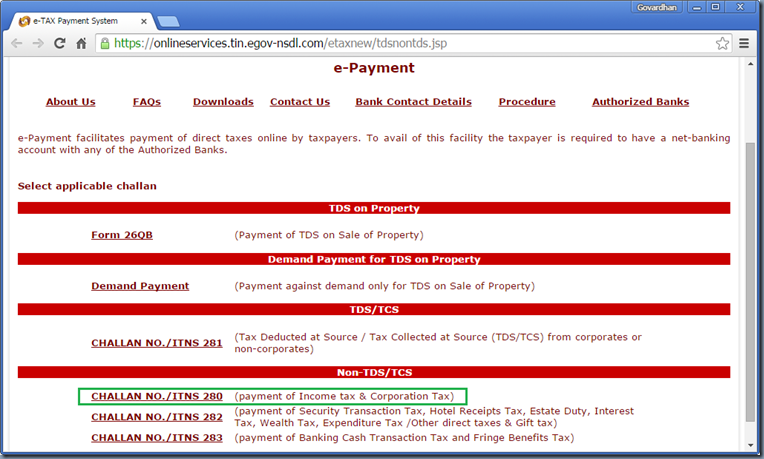

- On the e-Payment page, click on CHALLAN NO./ITNS 280 under Select applicable challan > Non-TDS/TCS section as shown below:

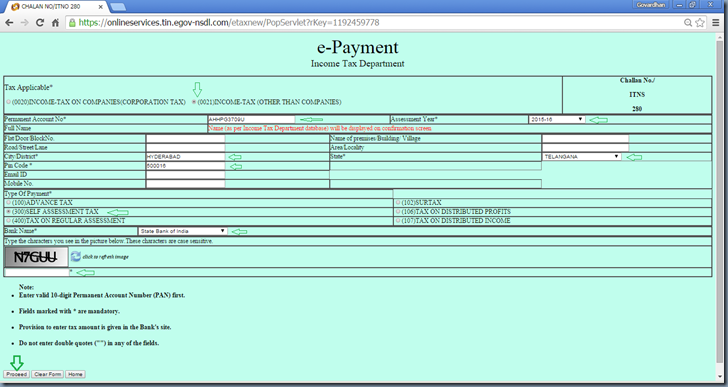

- You’ll be taken to the e-Payment page, update below details and then press Proceed button as shown below:

- Select (0021)INCOME-TAX (OTHER THAN COMPANIES) under “Tax Applicable*”

- Enter your PAN card details in “Permanent Account No*” field

- Select the appropriate value from the drop down list for “Assessment Year*”

- Enter City or District name in “City/District*” field

- Enter your area pin code in “Pin Code *” field

- Select your state from the drop down list of “State*” field

- Select (300)SELF ASSESSMENT TAX under “Type Of Payment*” field

- Select your Bank Name from the drop down list of “Bank Name*” field

- Enter the captcha/string that is shown in the captach string box “Type the characters you see in the picture below.These characters are case sensitive.”

- Then Click on Proceed button as shown in the below example

- Go to ITR-I form > Tax Details > “Sch IT Details of Advance Tax and Self Assessment Tax Payments” then enter the values for

- BSR Code

- Date of Deposit (DD/MM/YYYY)

- Challan Number

- Tax paid

- then click save draft