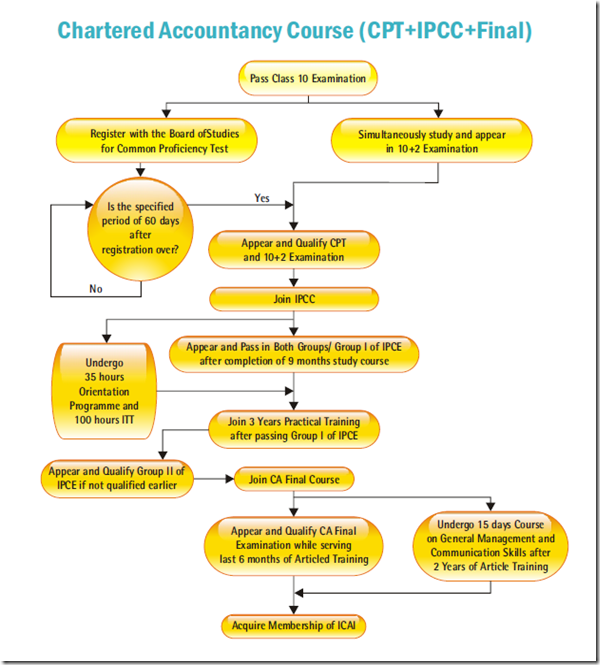

Under the existing chartered accountancy scheme of education, training and examination, the

requirements for becoming a chartered accountant (like those who work for the kinds of companies you can click here for more info about) are as follows:

(i) Enrol with the Institute for Common Proficiency Test (CPT) after passing class 10th

examination conducted by an examining body constituted by law in India or an examination

recognized by the Central Government as equivalent thereto.

(ii) Appear in CPT after appearing in the senior secondary examination (10+2 examination)

conducted by an examining body constituted by law in India or an examination recognized by

the Central Government as equivalent thereto and after completion of specified period (60 days) from the date of registration for CPT with the Board of Studies as on the first day of the month in which examination is to be held, viz., students registered on or before 1st April/1st October will be eligible to appear in June/December examination, as the case may be. However, candidate should pass both CPT and 10+2 before registering for Integrated Professional Competence Course (IPCC).

(iii) Enrol for Group I or Group II or for both Group I and Group II of Integrated Professional

Competence Course (IPCC) to become “Chartered Accountant”.

(iv) Successfully complete 9 months of study course from the date of IPCC registration.

(v) Successfully complete Orientation Course of one week spanning 35 hours and covering

topics, such as personality development, communication skills, office procedure, business

environment, general commercial knowledge, etc., before commencement of articled training.

(vi) Successfully complete 100 hours Information Technology Training (ITT) before commencement of articled training.

(vii) Appear and pass Group I as well as Group II of Integrated Professional Competence

Examination (IPCE). Group I is composed of four papers and Group II is composed of three papers.

(viii) Register as Articled Assistant for a period of 3 years, on passing either Group I or both the Groups of IPCE.

(ix) Register for CA Final Course and prepare for CA Final Examination.

(x) Undergo General Management and Communication Skills (GMCS) (15 days) course while

undergoing Final Course and serving the last 12 months of articled training.

(xi) Complete 3 years period of articled training.

(xii) Appear in the Final Examination on completion of the practical training or while serving last 6 months of articled training on or before the last day of the month preceding the month in which the examination is to be held.

(xiii) Pass final examination and complete GMCS, if not completed earlier.

(xiv) Enrol as a member of ICAI and designate as “Chartered Accountant”.

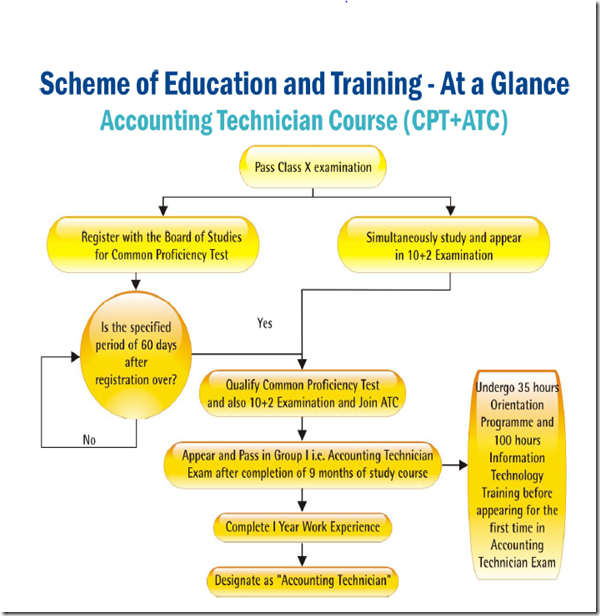

How to become an Accounting Technician

(i) Enrol with the Institute for Common Proficiency Test (CPT) after passing class 10th

examination conducted by an examining body constituted by law in India or an examination

recognized by the Central Government as equivalent thereto.

(ii) Appear in CPT after appearing in the senior secondary examination (10+2 examination)

conducted by an examining body constituted by law in India or an examination recognized by

the Central Government as equivalent thereto and after completion of specified period (60 days) from the date of registration for CPT with the Board of Studies as on the first day of the month in which examination is to be held, viz., students registered on or before 1st April/1st October will be eligible to appear in June/December examination, as the case may be. However, candidate should pass both CPT and 10+2 before registering for Accounting Technician Course (ATC).

(iii) Enrol for ATC.

(iv) Successfully complete 9 months of study course from the date of ATC registration.

(v) Successfully complete Orientation Course of one week spanning 35 hours and covering

topics, such as personality development, communication skills, office procedure, business

environment, general commercial knowledge, etc.

(vi) Successfully complete 100 hours Information Technology Training (ITT).

(vii) Appear and pass Accounting Technician Examination (ATE) (i.e. Group I of Integrated

Professional Competence Examination (IPCE)) comprising of four papers.

(viii) Successfully complete one year work experience under a chartered accountant in practice or in industry.

(ix) Get Accounting Technician Certificate.

(x) Designate as “Accounting Technician”.

How to become a CA, even after becoming Accounting Technician

(i) Enrol for Group II of Integrated Professional Competence Course (IPCC).

(ii) Register as an Articled Assistant for a period of 3 years.

(iii) Appear and pass Group II of Integrated Professional Competence Examination (IPCE)

comprising of three papers.

(iv) Register for CA Final Course and prepare for CA Final Examination.

(v) Undergo General Management and Communication Skills (GMCS) (15 days) course while

undergoing Final Course and serving the last 12 months of articled training.

(vi) Complete 3 years period of articled training.

(vii) Appear in the Final Examination on completion of the practical training or while serving last 6 months of articled training on or before the last day of the month preceding the month in which the examination is to be held.

(viii) Pass final examination and complete GMCS, if not completed earlier.

(ix) Enrol as a member of ICAI and designate as “Chartered Accountant”.

Reference: Chartered Accountancy Course